Overall Score 6.0

TASK 1

You should spend about 20 minutes on this task.

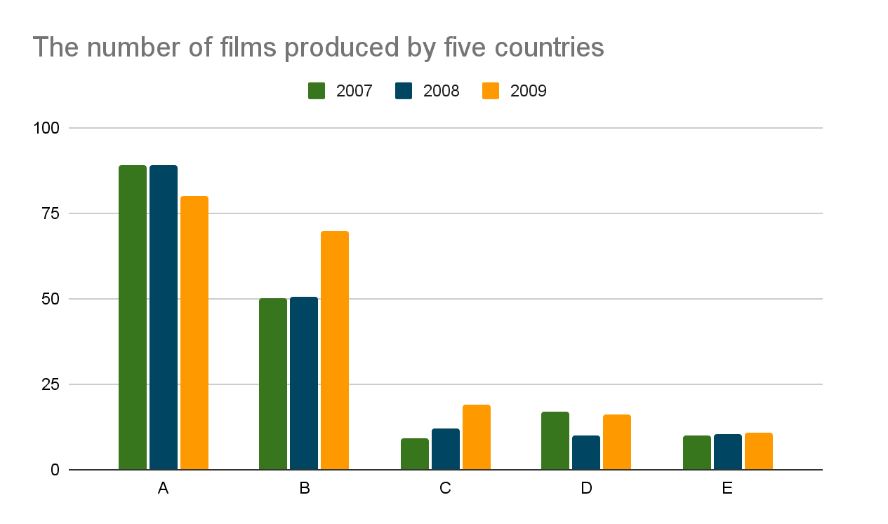

The graph below shows the number of films produced by five countries in three years. Summarise the information by selecting and reporting the main features, and make comparisons where relevant.

You should write at least 150 words.

The graph illustrates the amountnumber of films generated by five nations (A, B, C, D, E) in a span of three years.

Overall, country A had the leading film production for the entire three years, and the least film production in the same period was from country E.BCountry B was fairly high while being followed by C and D.

In addition, Country A produced the highest number of films in three years with valuesavaragingaveraging above 75. Although 2007 and 2008 led with the same value of approximately above 85, 2009 followed with a value above 75. On the other hand, country B took the second possitionposition, and registered 50 films for both 2007 and 2008. 2009 took the lead with a value approximately above 60.

However, Countries C, D, and E registered the lowest film production numbers of less than 25.ECountry E had the lowest values thancompared to C and D for all the three years.

Overall, country A had the leading film production for the entire three years, and the least film production in the same period was from country E.

In addition, Country A produced the highest number of films in three years with values

However, Countries C, D, and E registered the lowest film production numbers of less than 25.

(158 words)

Deleted: amount

Incorrect usage, should be 'number'

Added: number

Correct usage for countable items

Deleted: B

Incomplete reference to the country

Added: Country B

Clarified reference to the country

Deleted: avaraging

Spelling mistake

Added: averaging

Corrected the spelling to 'averaging'

Deleted: possition

Spelling mistake

Added: position

Corrected the spelling to 'position'

Deleted: E

Incomplete reference to the country

Added: Country E

Clarified reference to the country

Deleted: than

Incorrect comparative usage

Added: compared to

Correct comparative usage

Deleted: the

Unnecessary article

Task 1 Overall score: 6.0

6.0

The task is addressed, and the main features of the graph are mentioned. However, there is a lack of detailed data, such as specific figures for each country, which would strengthen the task achievement. Additionally, some comparisons could be more specific.

6.0

The overall structure is logical, and there is an attempt to compare the data. However, some sentences lack cohesion, and transitions between points could be smoother. The essay could benefit from clearer paragraphing or more cohesive devices for better flow.

6.0

The vocabulary used is appropriate but limited. There is some repetition of words and phrases, such as "film production" and "country." A wider range of vocabulary would improve the score, and more precise word choices would enhance clarity.

5.0

There are noticeable grammatical errors, such as incorrect use of articles ("the amount of films"), spelling mistakes ("possition"), and incorrect prepositions ("in a span of three years"). These errors impact the overall readability and accuracy. Sentence structures are generally simple.

Sample Answer Overall Score: 7.0

The graph presents data on film production in five countries: A, B, C, D, and E, over the period from 2007 to 2009.

Overall, Country A consistently led in film production across all three years, while Country E consistently produced the fewest films. Countries B, C, and D showed moderate levels of production with some fluctuations.

In 2007, Country A produced around 90 films, making it the highest producer, followed closely by Country B with approximately 50 films. Countries C and D produced around 30 and 20 films, respectively, while Country E produced fewer than 10 films. In 2008, Country A maintained its leadership, producing slightly more than 85 films. Country B's production remained stable at 50 films. In contrast, Country C increased its output to approximately 35 films, while Country D's production remained constant at around 20 films. Country E's production was again the lowest, with fewer than 10 films.

By 2009, Country A saw a slight decline to around 80 films. Country B, however, increased its production to about 60 films, surpassing previous years. Countries C and D maintained similar levels of production with slight increases, while Country E consistently remained the lowest producer, producing fewer than 10 films each year.

Overall, Country A consistently led in film production across all three years, while Country E consistently produced the fewest films. Countries B, C, and D showed moderate levels of production with some fluctuations.

In 2007, Country A produced around 90 films, making it the highest producer, followed closely by Country B with approximately 50 films. Countries C and D produced around 30 and 20 films, respectively, while Country E produced fewer than 10 films. In 2008, Country A maintained its leadership, producing slightly more than 85 films. Country B's production remained stable at 50 films. In contrast, Country C increased its output to approximately 35 films, while Country D's production remained constant at around 20 films. Country E's production was again the lowest, with fewer than 10 films.

By 2009, Country A saw a slight decline to around 80 films. Country B, however, increased its production to about 60 films, surpassing previous years. Countries C and D maintained similar levels of production with slight increases, while Country E consistently remained the lowest producer, producing fewer than 10 films each year.

Summary of the Key Improvements

1 . Task Achievement

- Include more specific data points to support statements.

- Make clearer and more detailed comparisons between countries.

2 . Coherence and Cohesion

- Use more cohesive devices to improve the flow between sentences and paragraphs.

- Consider clearer paragraphing to separate different comparisons.

3 . Lexical Resource

- Expand vocabulary to avoid repetition.

- Use more precise and varied vocabulary to describe data.

4 . Grammatical Range and Accuracy

- Pay attention to grammatical errors, especially articles, spelling, and prepositions.

- Use a mix of complex and simple sentences to demonstrate grammatical range.

TASK 2

You should spend about 40 minutes on this task.

People believe that they should be able to keep all the money they earn and should not pay tax to the state. To what extent do you agree or disagree with this statement?

Give reasons for your answer and include any relevant examples from own knowledge or experience.

You should write at least 250 words.

People tend to think that they should receive all the money and avoid taxes inon their earnings. In my opinion, I disagree with the statement since taxes play an important role in a nation's development.

Firstly,Oneone of the biggest revenue generatorgenerators of a state is through taxes. The taxes received from citizens are being utilized in a way that facilitates easy living and provisions of services to its citizens. Withholding the state from taking the taxes will slow the growth of a nation's developmentsdevelopment as well as reductionsreduce in provisions of social services. It is therefore vital to allow the state to keep taxing its own people for easy provision of services required and to keep the nation's reputation in terms of considering its people.

In addition, the quality oflivelife of the people is majorly determined by what the state provides to them. Poor quality of living is highly attributed to a nation that does not give attention to its citizencitizens by considering their needs and wants. It is through the money gained from taxes that will enableenables the efficiency of promoting quality of living. For example, the taxes received will be used to subsidize food, housing and, healthcare costs, thus enabling people to meet their needs at a lower cost.

To conclude, taxes play an important role inthe society. It helps the nation to develop infrustructureinfrastructure and provide services to its people in a simpler manner. The quality of liveslife is also enhanced through taxes as it is a key ingridientingredient to governmantgovernment subsidization of things like;like food, housing and, healthcare costcosts.

Firstly,

In addition, the quality of

To conclude, taxes play an important role in

(261 words)

Deleted: in

Replaced with 'on' for correct preposition

Added: on

Corrected preposition

Deleted: One

Corrected capitalization

Added: one

Corrected capitalization

Deleted: generator

Corrected to plural form

Added: generators

Corrected to plural form

Deleted: being

Removed unnecessary word

Deleted: developments

Corrected to singular form

Added: development

Corrected to singular form

Deleted: reductions

Corrected to verb form

Added: reduce

Corrected to verb form

Deleted: live

Corrected spelling

Added: life

Corrected spelling

Deleted: citizen

Corrected to plural form

Added: citizens

Corrected to plural form

Deleted: will enable

Corrected tense

Added: enables

Corrected tense

Deleted: and

Added comma for list

Added: ,

Added comma for list

Deleted: the

Removed unnecessary article

Deleted: infrustructure

Corrected spelling

Added: infrastructure

Corrected spelling

Deleted: lives

Corrected to singular form

Added: life

Corrected to singular form

Deleted: ingridient

Corrected spelling

Added: ingredient

Corrected spelling

Deleted: governmant

Corrected spelling

Added: government

Corrected spelling

Deleted: like;

Corrected punctuation

Added: like

Corrected punctuation

Deleted: and

Added comma for list

Added: ,

Added comma for list

Deleted: cost

Corrected to plural form

Added: costs

Corrected to plural form

Task 2 Overall score: 6.0

6.0

The essay addresses the task and presents a clear position against the notion of not paying taxes. However, the arguments could be more developed with additional specific examples and explanations. While the essay covers the importance of taxes, it lacks depth in explaining how tax revenue directly impacts various sectors such as education, infrastructure, and public safety.

6.0

The essay is organized logically, with clear paragraphing. The use of linking words, such as "firstly" and "in addition," helps with the flow, but there is room for improvement in the variety and complexity of cohesive devices. Some sentences could be better connected to enhance the overall cohesion of the essay.

6.0

The vocabulary used is appropriate, but there is a lack of variety and sophistication. Phrases like "biggest revenue generator" and "quality of living" are repeated, and the essay would benefit from a wider range of vocabulary and more precise word choices to convey nuanced meanings.

5.0

The essay contains several grammatical errors, particularly in punctuation, capitalization, and sentence structure. For example, "One of the biggest revenue generator of a state" should be "One of the biggest revenue generators of a state." These errors affect readability and demonstrate a limited range of sentence structures.

Sample Answer Overall Score: 7.0

The debate over whether individuals should be allowed to retain all their earnings without paying taxes is a contentious one. From my perspective, I strongly disagree with the notion of eliminating taxes, as they are indispensable for the functioning and development of any nation.

To begin with, taxes are the primary source of revenue for governments, which they use to provide essential services to their citizens. For instance, tax revenue funds healthcare systems, ensuring that people have access to necessary medical services regardless of their financial status. Without taxes, many citizens would be unable to afford healthcare, leading to a decline in public health. Furthermore, taxes are used to maintain and improve infrastructure, such as roads, bridges, and public transport. These are critical for economic growth, as they facilitate trade and enable people to commute to work efficiently.

Moreover, taxes contribute to social equity by redistributing wealth. Progressive tax systems, where individuals are taxed based on their income levels, help reduce income inequality. The revenue collected is often used for social welfare programs that support the less fortunate, such as unemployment benefits and food assistance. By not paying taxes, the gap between the rich and the poor would likely widen, leading to social unrest and decreased quality of life for many.

In addition, it is crucial for citizens to contribute to the society they live in. Paying taxes is a civic duty that allows individuals to partake in the collective progress of their nation. While there may be concerns about how tax money is spent, these can be addressed through greater transparency and accountability in government spending, rather than abolishing taxes altogether.

In conclusion, while the desire to keep all personal earnings is understandable, the abolition of taxes would have detrimental effects on society. Taxes are fundamental in funding public services, reducing inequality, and enabling societal development. It is imperative that citizens recognize the value of their contributions through taxes to the stability and growth of their nation.

To begin with, taxes are the primary source of revenue for governments, which they use to provide essential services to their citizens. For instance, tax revenue funds healthcare systems, ensuring that people have access to necessary medical services regardless of their financial status. Without taxes, many citizens would be unable to afford healthcare, leading to a decline in public health. Furthermore, taxes are used to maintain and improve infrastructure, such as roads, bridges, and public transport. These are critical for economic growth, as they facilitate trade and enable people to commute to work efficiently.

Moreover, taxes contribute to social equity by redistributing wealth. Progressive tax systems, where individuals are taxed based on their income levels, help reduce income inequality. The revenue collected is often used for social welfare programs that support the less fortunate, such as unemployment benefits and food assistance. By not paying taxes, the gap between the rich and the poor would likely widen, leading to social unrest and decreased quality of life for many.

In addition, it is crucial for citizens to contribute to the society they live in. Paying taxes is a civic duty that allows individuals to partake in the collective progress of their nation. While there may be concerns about how tax money is spent, these can be addressed through greater transparency and accountability in government spending, rather than abolishing taxes altogether.

In conclusion, while the desire to keep all personal earnings is understandable, the abolition of taxes would have detrimental effects on society. Taxes are fundamental in funding public services, reducing inequality, and enabling societal development. It is imperative that citizens recognize the value of their contributions through taxes to the stability and growth of their nation.

Summary of the Key Improvements

1 . Task Achievement

- Provide more detailed examples and explanations.

- Expand on how tax revenue impacts various sectors.

2 . Coherence and Cohesion

- Use a wider range of cohesive devices.

- Improve sentence connections for better flow.

3 . Lexical Resource

- Incorporate a broader range of vocabulary.

- Use more precise word choices for clarity.

4 . Grammatical Range and Accuracy

- Pay attention to punctuation and capitalization.

- Use varied sentence structures to avoid repetition and errors.

General Feedback